Understanding workers comp exemption in Florida can be tricky for business owners. It’s key for companies, LLCs, and freelancers to grasp the rules of workers compensation. This helps them handle their insurance duties well.

In Florida, business owners have choices to avoid standard workers’ compensation insurance. The workers comp waiver is a smart move for corporate officers and LLC members. It helps them manage their insurance needs effectively.

Every industry and business type has its own rules for workers’ compensation exemptions. Knowing these rules can guide entrepreneurs in choosing the right insurance. It can also help them save money.

Key Takeaways

- Florida allows workers comp exemptions for specific business structures

- Minimum 10% ownership is required for exemption qualification

- Exemptions are valid for two years

- Different rules apply for construction and non-construction industries

- Application fees and compliance tutorials are mandatory

Understanding Workers’ Compensation Exemptions in Florida

For business owners in Florida, understanding workers compensation laws can be tricky. Exemptions in workers’ comp laws offer a way for some professionals to handle their insurance needs smartly.

What is a Workers’ Comp Exemption?

In Florida, a workers comp exemption lets certain business owners skip mandatory workers’ compensation. This rule mainly applies to corporate officers, LLC members, and business owners who meet specific requirements.

Purpose of Obtaining an Exemption

Business owners get workers’ compensation exemptions for important reasons:

- Reduce operational insurance costs

- Provide flexibility in risk management

- Customize individual insurance strategies

Key Benefits and Limitations

It’s key to know the details of a Florida workers comp exemption for business planning. Here’s a detailed look:

| Benefits | Limitations |

|---|---|

| Lower insurance expenses | No workers’ compensation benefits if injured |

| Increased business flexibility | Potential increased personal liability |

| Customized risk management | Strict eligibility requirements |

“Knowledge of workers’ compensation laws empowers business owners to make informed decisions about their insurance coverage.” – Florida Business Insurance Association

Before getting a workers’ compensation exemption, business owners need to think about their industry, ownership, and risks.

Eligibility Requirements for Workers Comp Waiver Florida

Understanding the Florida workers comp waiver eligibility can be tricky for business owners. It’s key to know the exemption requirements well. This helps companies manage their insurance needs better.

To get a workers compensation waiver in Florida, businesses need to meet certain rules:

- Be registered as an active corporation or LLC with the Florida Department of State

- Have fewer than four regular employees (except in construction)

- Ensure corporate officers or LLC members meet ownership requirements

“Understanding your exemption status is key to protecting your business and employees.”

Important factors for workers comp waiver eligibility include:

| Business Type | Exemption Criteria |

|---|---|

| Corporation | Minimum 10% ownership for exempt officers |

| LLC | Maximum 10 exempt employees allowed |

| Construction | Stricter requirements with mandatory coverage |

Applicants must have a valid Florida ID or driver’s license. They also need to sign the exemption application personally. The whole process usually takes about 30 days, and there’s a fee for submitting it.

Some industries have special rules. Construction employers, for example, must cover all employees. This includes contractors, no matter how many workers they have.

Corporate Officer Requirements and Restrictions

Understanding the corporate officer exemption for Florida workers comp can be tricky. Business owners must grasp the rules that affect their exemption status.

Corporate officers have a special role in workers’ compensation laws. The Florida Division of Workers’ Compensation has set clear rules for those wanting an exemption.

Minimum Ownership Requirements

To get a corporate officer exemption, you must own a certain amount:

- Own at least 10% of the corporation

- Be listed as an officer in Florida Department of State records

- Be actively involved in managing the company

Documentation Needed for Corporate Officers

To get a corporate officer exemption, you need to provide detailed documents:

- Corporate Articles of Incorporation

- Proof of how much you own

- Registration with the Florida Division of Corporations

- A form confirming your corporate officer status

Maximum Number of Exempt Officers

Florida sets a limit on how many corporate officers can be exempt:

| Corporate Structure | Maximum Exempt Officers |

|---|---|

| Small Corporations | 4 officers |

| Large Corporations | 5 officers |

It’s important to document everything carefully to keep your exemption in Florida’s workers’ compensation system.

“Understanding the nuanced requirements can save your business significant time and resources.”

Limited Liability Company (LLC) Member Guidelines

Understanding workers’ compensation exemptions for Florida LLCs is key. It’s important for business owners to know the rules to protect their company.

Here are the main rules for LLC members to get workers’ compensation exemption in Florida:

- Minimum ownership of 10 percent in the LLC

- Maximum of 10 exempt members per LLC

- Personal application signature required

- Active registration with Florida Department of State

“Precision in documentation is essential for successful workers’ comp exemption applications.”

Florida LLC exemption rules are strict. To qualify, applicants must meet several important criteria:

- Provide a valid Florida ID or driver’s license

- Ensure no active Stop Work Order exists

- Pay required processing fees

- Complete the full application process

| Exemption Requirement | Details |

|---|---|

| Ownership Percentage | Minimum 10% LLC ownership |

| Maximum Exempt Members | 10 members per LLC |

| Application Processing Time | Approximately 30 days |

| Application Fee | $50 for construction industry |

Not following these rules can lead to big legal problems. This includes possible third-degree felony charges for wrong documentation.

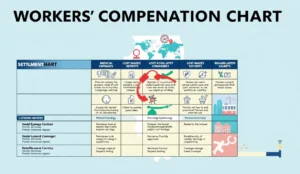

Construction vs Non-Construction Industry Requirements

Florida has different rules for construction and non-construction businesses. Knowing these differences is key for those looking for workers comp exemption in Florida.

Understanding the rules for construction workers comp exemption is important. The rules vary by industry.

Construction Industry Specific Rules

Construction businesses have strict workers compensation rules. Some key points include:

- Mandatory coverage with 1 or more employees

- Subcontractors considered employees for insurance purposes

- Maximum of three officers or LLC members can be exempt

Non-Construction Industry Specifications

Non-construction businesses have their own set of rules. These include:

- Insurance mandatory with 4 or more employees

- Sole proprietorships potentially exempt

- More flexible exemption rules

Fee Differences Between Industries

| Industry Type | Application Fee | Exemption Limit |

|---|---|---|

| Construction | $50.00 | 3 Officers/Members |

| Non-Construction | $25.00 | 10 Members |

Business owners must carefully evaluate their specific industry requirements to ensure full compliance with Florida’s workers compensation regulations.

Application Process and Documentation

Getting a Florida workers comp waiver requires attention to detail. Business owners must follow a specific process to get their exemption documents.

- Complete the online Exemption Application – DWC 250

- Prepare necessary identification documents

- Submit fingerprints for background verification

- Pay required application fees

“Precision in documentation is key to a successful workers’ comp waiver application in Florida.”

Applicants must meet certain requirements:

- Minimum age of 18 years

- Valid government-issued identification

- Proof of business ownership

- FICO-derived credit score

| Application Component | Processing Time |

|---|---|

| Fingerprint Background Check | Up to 5 business days |

| Application Submission | Online through Florida Division of Workers’ Compensation |

| Exemption Certificate Issuance | 30 days from application |

Special considerations exist for military veterans and Florida National Guard members, who may qualify for fee waivers or discounts. Business owners should carefully review all documentation requirements. This ensures a smooth application process for their Florida workers comp waiver.

Duration and Renewal of Exemption Certificates

Understanding the Florida workers comp exemption renewal process is key. Business owners need to know the rules to stay compliant and avoid fines.

In Florida, the life of a workers’ compensation exemption certificate is set by law. Here’s what you need to know:

Validity Period

A Certificate of Election to be Exempt has a set time frame:

- Certificates issued after January 1, 2013, last for exactly 2 years

- They expire at midnight, two years from when they were issued

- The exact dates are shown on the certificate

Renewal Requirements

To renew your exemption certificate, follow these steps:

- Apply for renewal at least 60 days before it expires

- Pay a $50 fee for construction industry certificates

- Fill out all required forms online

Important Deadlines

The Florida Division of Workers’ Compensation helps with renewals:

| Action | Timeframe |

|---|---|

| Expiration Notice | 60 days before expiration |

| Application Processing | Approximately 30 days |

| Effective Date | Up to 30 days after application |

“Renewing on time is vital to keep your workers’ compensation exemption in Florida.”

Business owners must keep track of their exemption certificate’s validity. Start the renewal process early to stay compliant with Florida laws.

Legal Implications and Responsibilities

Knowing about workers comp waiver liability in Florida is crucial. It’s about understanding the legal side. If you want to skip workers’ compensation, you must get the legal stuff right. This affects your business and personal safety.

There are key legal points to think about when exempting yourself in Florida:

- Personal liability for workplace injuries

- Potential financial risks without proper coverage

- Legal requirements for different business types

- Documentation and compliance obligations

“Understanding your legal obligations is key to protecting your business and employees.”

The application process requires strict personal accountability. You must sign and confirm you understand all the details. This is a legal promise to be truthful about your paperwork.

| Legal Aspect | Key Responsibility |

|---|---|

| Personal Signing | Verify all information accuracy |

| Injury Reporting | 30-day window for incident reporting |

| Coverage Verification | Confirm alternative protection mechanisms |

Remember, workers comp waiver liability is more than just paperwork. It’s about knowing the risks, keeping records right, and following Florida’s rules.

Common Mistakes to Avoid When Filing for Exemption

Filing for workers comp exemption in Florida can be tough. Many people make mistakes that can stop their application. It’s important to know these common errors to succeed with your Florida waiver application.

Critical Application Errors to Watch Out For

Applicants often make mistakes that can hurt their exemption request. Some common errors include:

- Incomplete or incorrect personal information

- Missing required supporting documentation

- Failing to meet ownership percentage requirements

- Submitting applications with unauthorized signatures

Compliance Challenges

Florida is strict about workers compensation rules. Any person other than the applicant signing the application may be guilty of a felony of the third degree. This shows how important it is to follow the exemption process carefully.

Documentation Mistakes to Avoid

Good documentation is key for a successful waiver application. Common mistakes include:

- Not providing proof of business ownership

- Submitting outdated or incorrect forms

- Failing to demonstrate the required 10% ownership stake

- Neglecting to renew exemption certificates on time

“Attention to detail can make the difference between a smooth exemption process and a rejected application.”

Applicants should carefully review all requirements and double-check their Florida waiver application to minimize mistakes. Getting help from a professional or reading all instructions carefully can prevent costly errors in the workers comp exemption process.

Conclusion

Understanding the Florida workers comp waiver is complex. It involves navigating through legal details. The exemption decision guide is key for businesses looking for protection.

Corporate officers and LLC members need to carefully look at their industry needs. They must also consider the legal risks involved.

Florida Statute § 440.11 offers important protections for employers. But, keeping up with workers’ compensation rules is essential. Losing immunity can lead to big legal problems.

Business owners should plan carefully. They need to know about filing, documentation, and keeping a consistent legal stance.

Getting help from legal experts is vital. They know the Florida workers’ compensation laws well. This can help businesses make smart choices.

Legal experts can help avoid costly mistakes. They understand the complex rules around exemptions.

The workers comp waiver in Florida is a key risk management tool. Businesses must weigh legal, financial, and workforce needs. By understanding the exemption landscape well, companies can protect themselves while following state laws.

FAQ

Who is eligible for a workers’ compensation waiver in Florida?

In Florida, business owners, corporate officers, and LLC members might get a waiver. It depends on if your business is registered, how much you own, and what kind of business you have. Construction and non-construction businesses have different rules for getting an exemption.

How much does a workers’ comp exemption cost in Florida?

The cost varies by industry. In 2023, construction exemptions cost around $50. Non-construction exemptions have different fees. The fees are low compared to the insurance savings.

How long is a workers’ comp waiver valid in Florida?

Most waivers in Florida last two years. After that, you must renew it to keep your exemption.

Can corporate officers be exempt from workers’ compensation?

Yes, corporate officers can be exempt. They must own at least 10% of the company. They also need to show they are officers with the right documents.

What are the risks of obtaining a workers’ comp waiver?

Getting a waiver means you can’t get workers’ comp if you get hurt on the job. You’ll have to pay for your own medical and lost wages if you get hurt.

How do construction and non-construction exemptions differ?

Construction exemptions have stricter rules and fees. Non-construction businesses have easier rules and lower costs.

Can LLC members get a workers’ comp waiver in Florida?

Yes, LLC members can get a waiver. They need to meet specific ownership and documentation rules. There are limits on how many members can be exempt in one LLC.

What documents do I need to apply for a workers’ comp exemption?

You’ll need proof of business registration and how much you own. You also need to show you’re a corporate officer or LLC member. And you’ll need to fill out an online application on the Florida Division of Workers’ Compensation website.

How long does the application process take?

The online application is quick, taking 15-30 minutes. Processing times vary, but most exemptions are approved in 5-10 business days.

Can I cancel my workers’ comp waiver if my business circumstances change?

Yes, you can cancel your exemption if your business changes. But make sure you have workers’ comp coverage if you’re no longer exempt.